Bien qu'il y ait une grande différence entre les méga opérations de fusion et d'acquisition dont vous lisez les articles dans les journaux et l'acquisition de votre magasin local, les principaux défis semblent être les mêmes.

Article en anglais , basé sur présentation Corum group Benelux Merge online event 05/08/2021.

Although there is a huge difference between mega M&A deals you read in the newspapers and the takeover of your neighbors’ department store, the main topics remain the same.

This is what we learned from today’s presentation of the Corum group Benelux Merge online event

1. When it comes to take over negotiations, buyers and sellers have 5 main topics to discuss

2. Independent on the size of the deal, the take over process follows 8 steps

Preparation is key = “By failing to prepare, you are preparing to fail” (B. Franklin)

In today’s market, sellers have the advantage : This is reflected in the fact that the majority of the deals are settled as a 100% cash transaction at closing. (no deferred payment)

3. Avoid mistakes

According to CORUM, one of the biggest mistakes you can make as a seller is to talk to only one buyer. Dealing with only one buyer limits your knowledge of the market.

From personal experience , I can add that in case you talk to only one buyer, the take over process will last longer and the risk remains that the deal will break up after several months of negotiation. So the seller has to start up the process all over again. This can lead to “deal fatigue”

Hence my advice, also in smaller SME deals => talk to as much potential buyers as you can cope with.

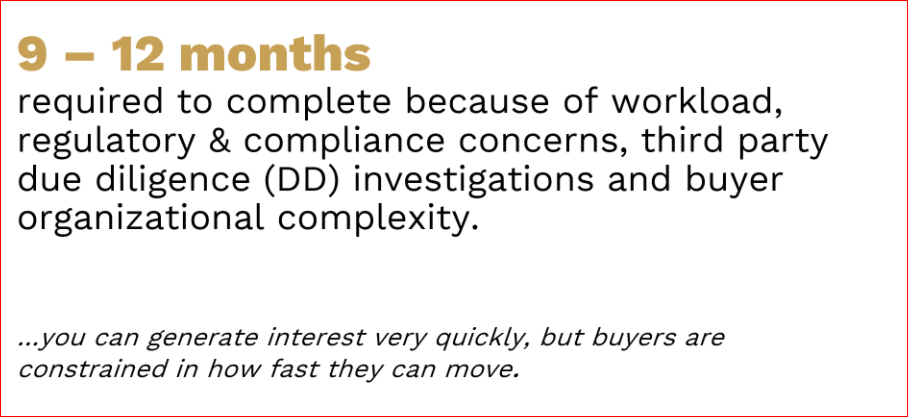

4. How long is a typical take over process?

This is similar to the take over process of small SME

5. Value destroyers

Contrary to many comments as how to optimize the sale of your company. it is wise to avoid mistakes that could jeopardize the sale of your business.

From my experience with take over of SME, I see that many entrepreneurs (shareholders) wait too long to prepare the succession of their business. They think that one day "a white knight" will come along and buy their business, but it does not work like that!

Major Benefits of a Professional M&A Process

It is clear that a professional preparation of the sale of your business is helpful to create value.

Not only to enhance the takeover process ; but bring your business to the next level This is true, also for a small SME.

This last slide summarizes the challenges of any company that is looking forward to become an attractive target for a take over

All slides are from CORUM

• Jon Scott, Chairman, Corum Group: jons@corumgroup.com

• Mark White, Vice-President Corum Group: markw@corumgroup.com

About CORUM

Corum Group is the global leader in merger and acquisition services, specializing in serving sellers of software and related technology companies worldwide. With offices globally, Corum has completed over $10B in software M&A transactions over the last 36 years. Corum's M&A advisors are highly experienced former tech CEOs, supported by industry-leading researchers, writers and valuators. Corum is the leading tech M&A educator worldwide with its popular conferences and publishes the most widely distributed software M&A research. For more information, visit www.corumgroup.com.